Back in March, I introduced Moby, our brand new Goldendoodle puppie. As a reminder, here is a picture of him when he first came home with us. I am not really known to be a cuddly, emotional kind of guy. But, seriously, AAAWWWEEE...Sweetie, cutie-pie...Who’s a good boy…Who’s a good boy…oh yeah... back to the blog.

Pretty cute, quiet and, after rereading the blog I wrote about him, my memory was jarred into remembering he was a lot of work. Still….time heals all wounds and many great improvements have taken place. First of all, he no longer conducts any of his…business, in the house. That is a super positive result. He also does not chew the heck out of all the wood in the house. We have to replace baseboards, window blinds and a table leg, but that behavior is gone. Woo-hoo, positive check number two. All good things. All good things.

Pretty cute, quiet and, after rereading the blog I wrote about him, my memory was jarred into remembering he was a lot of work. Still….time heals all wounds and many great improvements have taken place. First of all, he no longer conducts any of his…business, in the house. That is a super positive result. He also does not chew the heck out of all the wood in the house. We have to replace baseboards, window blinds and a table leg, but that behavior is gone. Woo-hoo, positive check number two. All good things. All good things.

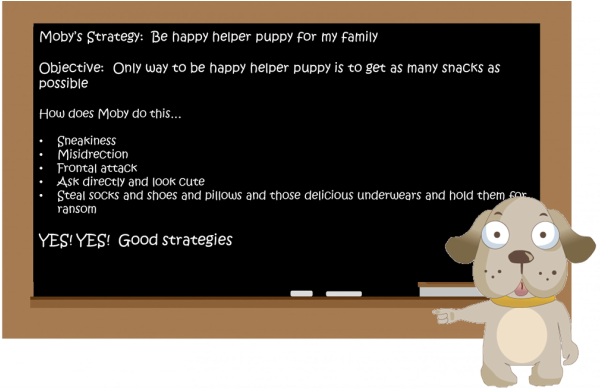

So, here is Moby now. Obviously, he has changed significantly. He is much larger (I am brilliant at stating the obvious, thank you very much). He is also loving and sweet. Mr. Moby has really settled into being an integral part of the family. That is not to say we have no issues. Where before we just had normal puppy troubles, we now have a full throttled, critically thinking bundle of strategic energy. Our little cutie has developed strategies to get what he wants. He kindly summarized them in the following graphic (I actually made the graphic, he just told me what to write down).

I am not sure his premise is correct that getting more snacks makes him a better helper, but what the heck, let’s just run with it. He has developed strategies to ensure that he gets the necessary sustenance to be that good helper. He sneaks food when we are not looking. A missing plate of raw hamburger proves that. He acts like he is interested in one food item, say a tangy, pucker-inducing yellow citrus fruit, and then drops it and runs to steal a more appetizing morsel when we reach to pick up the fruit (see picture…that is not a ball in his mouth, it is a LEMON).

The following pictures illustrate the point even more. He steals socks and pillows, takes them into the backyard or into other rooms of the house, and holds them for ransom until we provide a treat. Should we treat him for stealing our stuff? Of course not, but he is incredibly fast and impossible to catch when he gets outside. We are trying to change the behavior, but sometimes I am running late and just want my dang socks.

The following pictures illustrate the point even more. He steals socks and pillows, takes them into the backyard or into other rooms of the house, and holds them for ransom until we provide a treat. Should we treat him for stealing our stuff? Of course not, but he is incredibly fast and impossible to catch when he gets outside. We are trying to change the behavior, but sometimes I am running late and just want my dang socks.

So, as business owners, what can we learn from this “dumb” dog? Creating plans and strategies to meet objectives is smart business. Strategic planning is an evolving, dynamic process that adapts to surroundings and the business environment to accomplish a beneficial goal. Every business, no matter its size, should create strategic plans that contain measurable objectives with timetables and responsibilities. These objectives should be changed and evolved as market conditions change.

The old Soviet planning method created five-year plans that remained static and monolithic. And, of course, the Soviet Union collapsed. Trying different tactics to reach the goal is important and can keep an organization agile. Be willing to move and adjust. Learning what does not work is a critical part of planning and strategic thinking. Think in terms of plan, evaluate and evolve and then repeat, repeat, repeat. It has worked for my dog and I think it will work for you. Moby is available for a consult at your earliest convenience. Just make sure you leave your socks on.

The old Soviet planning method created five-year plans that remained static and monolithic. And, of course, the Soviet Union collapsed. Trying different tactics to reach the goal is important and can keep an organization agile. Be willing to move and adjust. Learning what does not work is a critical part of planning and strategic thinking. Think in terms of plan, evaluate and evolve and then repeat, repeat, repeat. It has worked for my dog and I think it will work for you. Moby is available for a consult at your earliest convenience. Just make sure you leave your socks on.

RSS Feed

RSS Feed