I have been writing this blog for a few years now and have developed a reasonable following, especially considering it often discusses a very arcane lending program (the SBA 504 Loan Program) or economic factors that influence commercial real estate lending. One thing that I have noticed is that when I write a blog that includes my dog Moby, I tend to get more readers. With this in mind, I am going to treat this “wonkie” blog like one of those low budget 80’s movies. I am going to discuss interest rates for last 13 years and occasionally throw in scenes of gratuitous S&V (slobbering and vigor….. Did you think I meant sex and violence?..... Please, this is a family blog). The actual title of this blog is “Comparative 504 versus Conventional Commercial Lending Rates.” Certainly not quite as enticing as “My Dog Ate My Underwear,” but hopefully still informative and enjoyable.

Before I start discussing the data, let me quickly explain the methodology. Boring alarms are going off….Here is a picture of Moby.

Before I start discussing the data, let me quickly explain the methodology. Boring alarms are going off….Here is a picture of Moby.

Since bond sales determine the 504 loan’s interest rate, historical rates are consistent across the country and very easy to find. The National Association of Development Companies (NADCO), the group that represents companies like Enterprise Development, makes the 504 historical rates readily available.

Finding average commercial interest rates offered by banks required more research and assumptions. Bank commercial rates vary from market to market and are based on a number of factors, including the prime interest rate, the risk premium required and the competitive market. I used historical data from the Wall Street Journal to determine the prime interest rate from 2002 to 2015 and then reviewed risk premium data provided by the World Bank. I then used local knowledge to estimate how the competitive environment affects local interest rates.

I reviewed January and December 504 rates over the period and then took an average of each to create a composite rate.

The commercial rate was determined by creating a composite rate by adding prime, plus the World Bank’s risk premium estimate and then adjusting the risk premium based on my knowledge of the local competitive environment. The 2014 and 2015 commercial risk premium is an assumption I made with the knowledge that a number of banks have dropped rates to historically low levels as a response to extreme competition.

I did some ciphering and voila, I could make a reasonable comparison to determine if, historically, the 504 is actually a good deal.

Sorry about the blah, blah, blahing…. Here is a close up if Moby.

Finding average commercial interest rates offered by banks required more research and assumptions. Bank commercial rates vary from market to market and are based on a number of factors, including the prime interest rate, the risk premium required and the competitive market. I used historical data from the Wall Street Journal to determine the prime interest rate from 2002 to 2015 and then reviewed risk premium data provided by the World Bank. I then used local knowledge to estimate how the competitive environment affects local interest rates.

I reviewed January and December 504 rates over the period and then took an average of each to create a composite rate.

The commercial rate was determined by creating a composite rate by adding prime, plus the World Bank’s risk premium estimate and then adjusting the risk premium based on my knowledge of the local competitive environment. The 2014 and 2015 commercial risk premium is an assumption I made with the knowledge that a number of banks have dropped rates to historically low levels as a response to extreme competition.

I did some ciphering and voila, I could make a reasonable comparison to determine if, historically, the 504 is actually a good deal.

Sorry about the blah, blah, blahing…. Here is a close up if Moby.

Thankfully, the methodology discussion is over. By the way, I used to work in academia. The methodology in this blog compared to academic research methodologies is like comparing “Die Hard” to “Moby Dick.” Trust me, this methodology is way snappier, which is less a compliment of my writing than an accusation and indictment of the unmitigated dullness of an academic methodology composition.

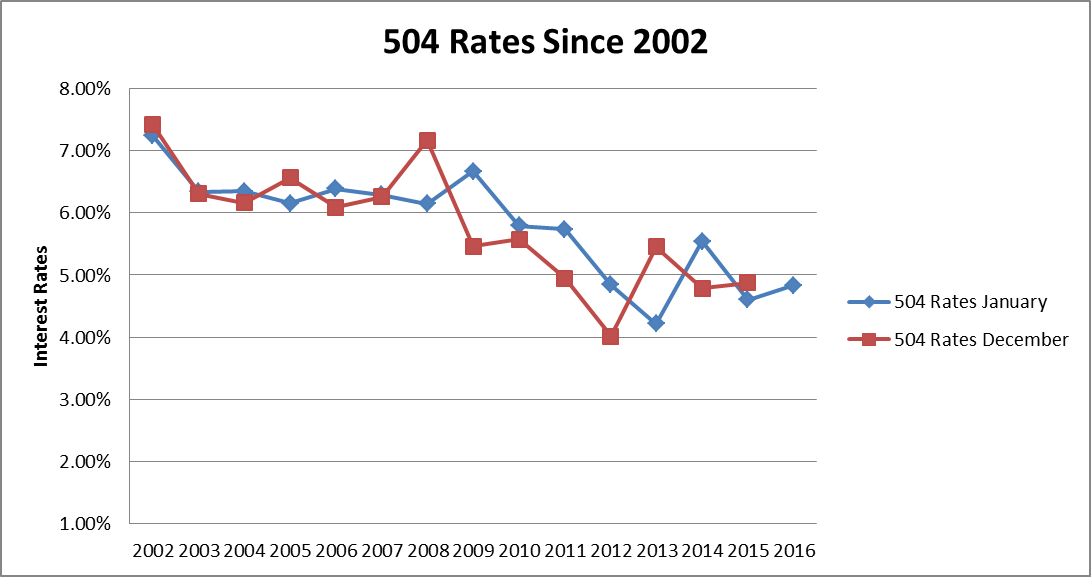

So, here we go. The following graph shows January and February 504 rates since 2002.

The graph illuminates that 504 interest rates were higher in the early 2000’s. This can be explained when considering the events of September 11th, 2001 and the collapse of the real estate market in the late 00’s. Once the “Great Recession” grabbed the country, rates dropped in an attempt to stimulate economic growth.

And now to keep you reading, here is a provocative picture of Moby.

And now to keep you reading, here is a provocative picture of Moby.

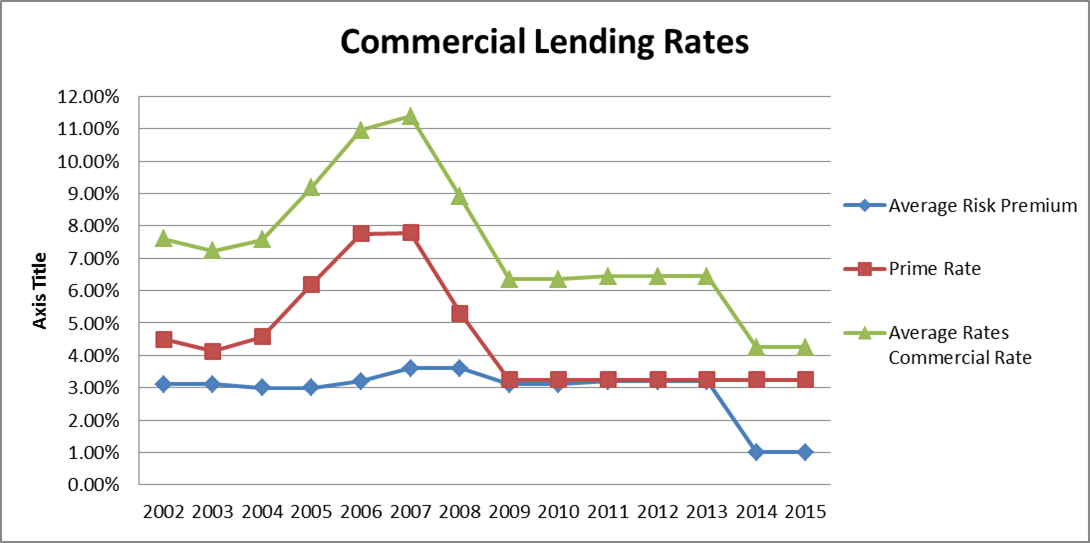

Alrighty then... Let's look at a graph that shows average commercial rates and its corresponding parts.

It is important to remember that conventional commercial rates and 504 rates are tied to different indexes and risk premiums. Commercial rates are linked to a number of different indexes, but for this example, I used the prime interest rate and an average national risk premium while the 504 loan is tied to Treasury Bills and bond market risk premiums. Even considering the different make-up between the two, the commercial rates graph shows a similar curve as the 504 graph and it is reasonable to assume the same factors that affected the 504 market affected the commercial market.

And now, Moby and his stogie…

And now, Moby and his stogie…

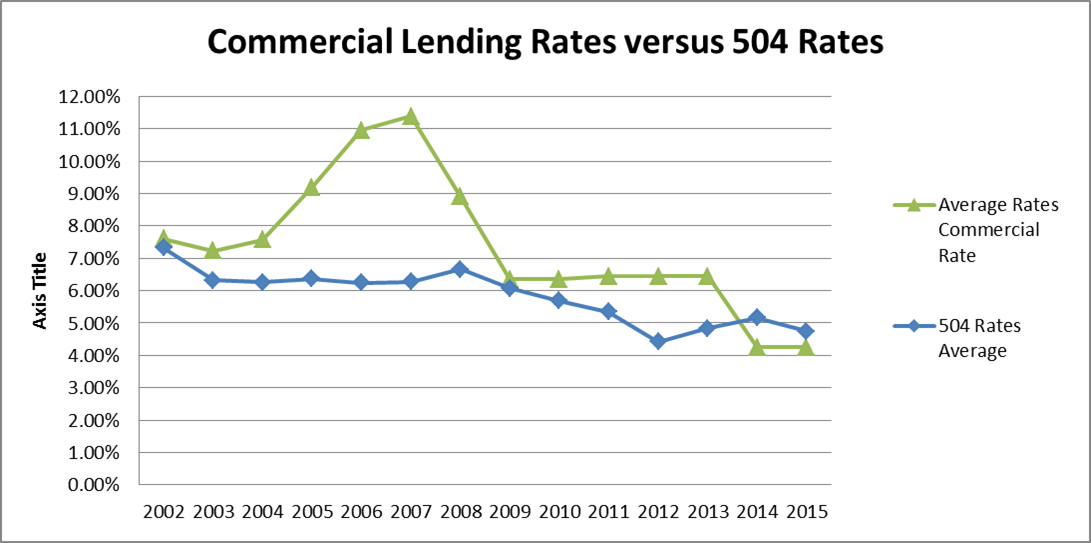

The following graph directly compares the 504 interest rates to commercial rates.

This data points on this graph are a compendium of national rates and local rates and may not completely represent the rates of any specific bank. These are national average estimates with a little local flavor thrown in for good measure. Inarguably, 504 rates have, on average, been lower than conventional rates and really are a good deal for the borrower. Even when you consider 504 fees, the difference between the two rates is great enough that the 504 makes sense to use in conjunction with a traditional commercial loan.

Finally, here is another compendium of two more things that work in harmony for the betterment of a business owner (me)…

Finally, here is another compendium of two more things that work in harmony for the betterment of a business owner (me)…

As discussed in an earlier blog, Moby has a compulsion to steal things. Those things are usually underwear and shoes, but he found my coat irresistible. And following the gratuitous 80’s movie strategy I have been utilizing throughout this blog, this is our guinea pig Nona (her sister Holly the guinea pig refused to take part in such a dodgy deal). DON’T FORGET, THE 504 IS GOOD DEAL. Cut to images of Holly and Moby running along the beach with the surf splashing around them and… Cut…Close scene and…Good job people, that’s a wrap!

RSS Feed

RSS Feed