Borrowers... The Power of Ownership

|

Enterprise Development Corporation is a not-for-profit Certified Development Company (CDC) with one mission... Financing the growth of small businesses in Missouri. Offering 504 refinance loans to small business owners allows them the security knowing that they will have a fixed interest rate throughout the life of the loan.

Our knowledgeable staff will provide you with the tools and assistance you need to secure an SBA 504 loan. We will use our experience and dedication to customer service to ensure that borrowing to grow your business will go smoothly A SBA 504 loan can provide the best possible financing structure available for refinancing real estate and equipment.

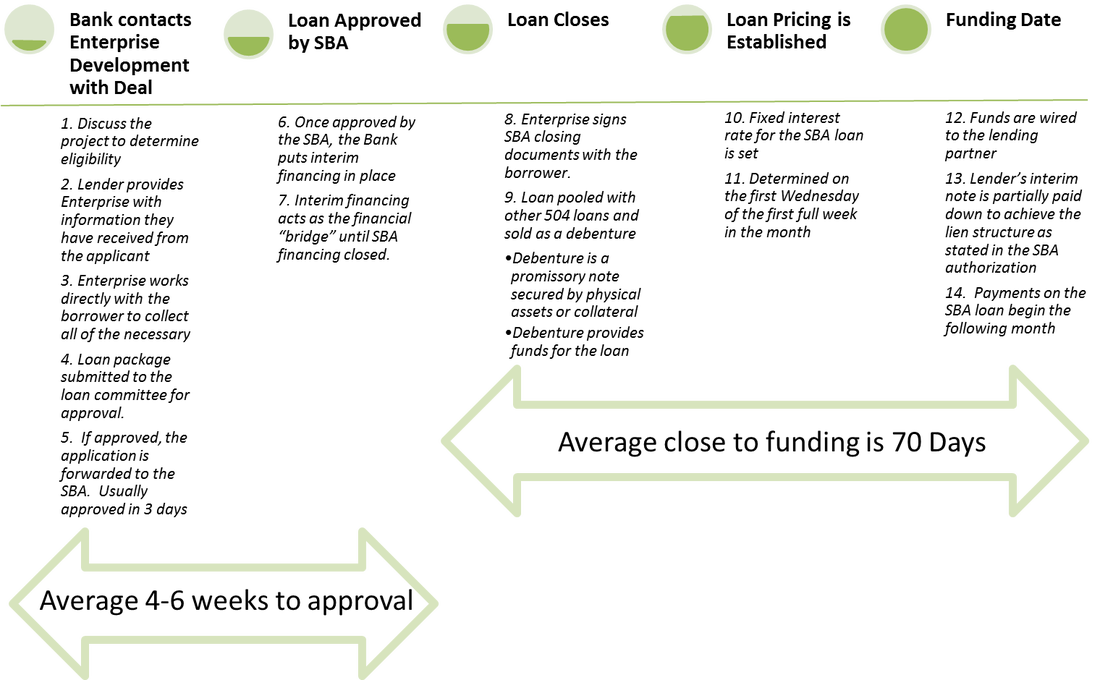

504 Refinance Process |